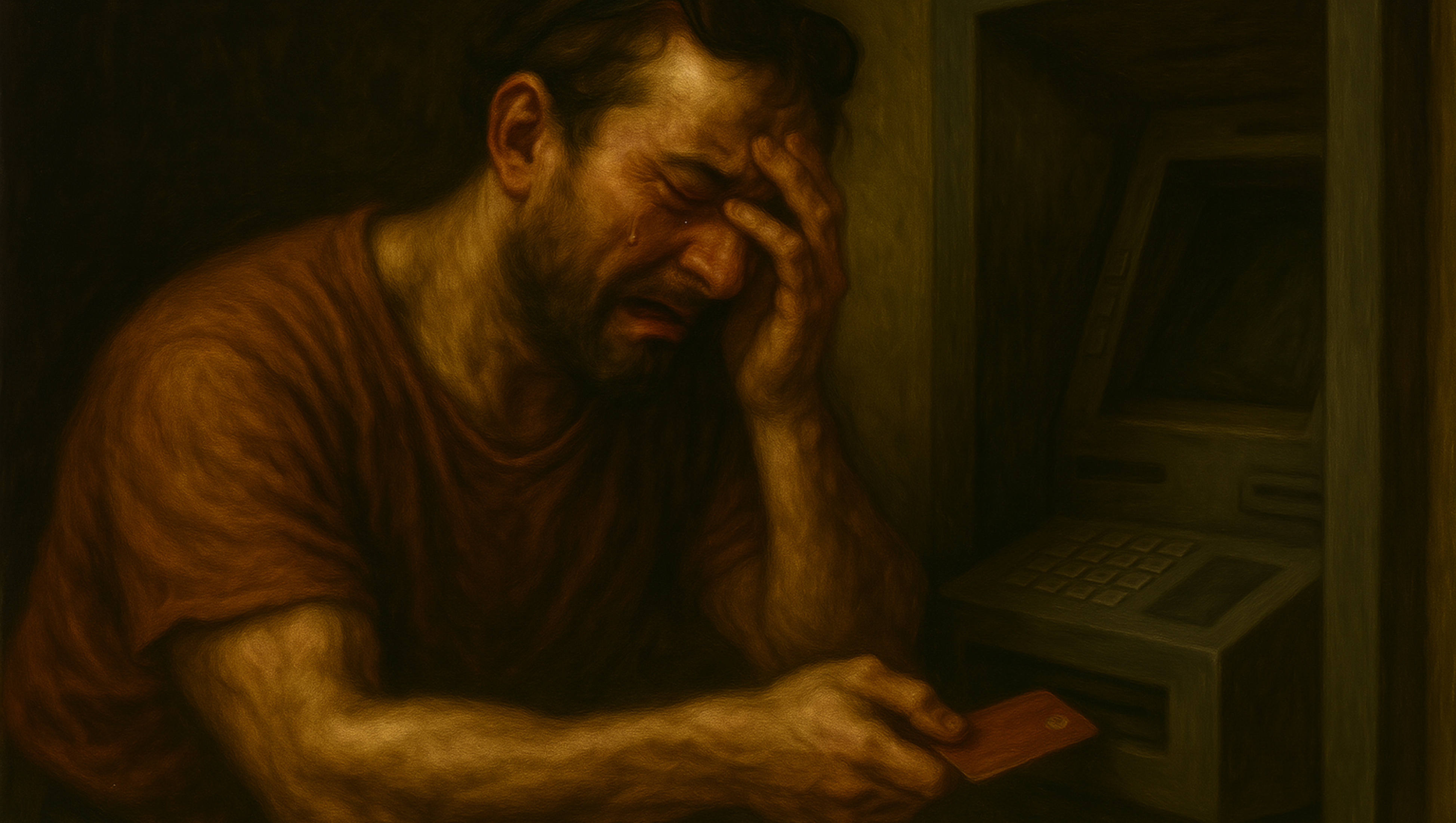

Shimming, not to be confused with phishing or smishing, is the latest in a long list of words, made up by IT people with too much time on their hands, that you need to be aware of when trying to keep your card details safe.

Like your buying power in recent years, card readers that "skim" your card details have shrunk to the extent that they are now so small "a shim" that they can fit inside the legitimate card reader making them very hard to identify. Some types read information travelling between the card and the reader, while others block legitimate transactions via chip and force rollback to mag stripe as an option. Generally, they don't impact the legitimate operation of the card payment device, so the fact that the card machine worked is no indicator of whether it is compromised.

This is more of an issue in the USA as they generally have older technology and slightly more lax rules with regard to credit cards but as we go on holidays to tourist heavy areas where a more mixed technology stack is needed for compatibility or even travel to the US you are still at risk.

Things you can do for now to help and reduce risk.

Avoid isolated ATM's or unmanned pay pumps for example.

If you have to use them, try using contactless, as NFC is not subject the same risks.

If you can't use contactless, try to use your credit card and not your debit card. Your credit card has some extra contractual protections and insurance generally.

If it feels a bit odd, go with your gut. Just use the cashier and pay cash.

Now, relax and enjoy the rest of the holiday season.